How to Navigate Prevailing Wage Regulations

- Paula Stratigos

- Sep 15, 2025

- 4 min read

Understanding and complying with prevailing wage regulations is essential for contractors, subcontractors, and public agencies involved in government-funded construction projects. These laws ensure that workers receive fair wages based on local standards, promoting equitable pay and preventing undercutting of labor costs. However, navigating the complex rules and requirements can be challenging without clear guidance.

This article breaks down the key aspects of prevailing wage regulations, offering practical advice and examples to help you stay compliant and avoid costly penalties.

What Are Prevailing Wage Regulations?

Prevailing wage laws require contractors on public works projects to pay workers wages and benefits that are comparable to those paid to workers in similar jobs in the local area. These laws are designed to protect local labor markets and ensure fair compensation.

The wage rates are typically determined by government agencies through surveys of local wages in various trades. For example, if the prevailing wage for a carpenter in your county is $30 per hour plus benefits, contractors must pay at least that amount on public projects.

Key points about prevailing wage regulations:

They apply primarily to public construction projects funded by federal, state, or local government.

Wage rates vary by location, trade, and project type.

Compliance requires accurate record-keeping and reporting of worker hours and wages.

How Prevailing Wage Affects Your Project Budget

Incorporating prevailing wage requirements into your project budget is crucial. These wages are often higher than standard market wages, which can increase labor costs significantly.

Example:

A contractor bidding on a public school renovation must factor in the prevailing wage rates for electricians, plumbers, and laborers. If the local prevailing wage for electricians is $45 per hour with benefits, but the contractor usually pays $35 per hour, the budget must be adjusted accordingly.

Tips for managing costs:

Obtain accurate wage determinations early - Contact the relevant government agency or use online resources to get the latest wage rates.

Include fringe benefits - Prevailing wage often includes benefits like health insurance and retirement contributions.

Plan for overtime - Some projects require overtime pay at higher rates.

Use detailed labor cost estimates - Break down labor costs by trade and hours to avoid surprises.

Understanding these factors helps prevent underbidding and ensures your project remains financially viable.

Understanding Compliance and Reporting Requirements

Compliance with prevailing wage laws involves more than just paying the correct wages. Contractors must maintain detailed records and submit reports to demonstrate adherence.

Common compliance requirements include:

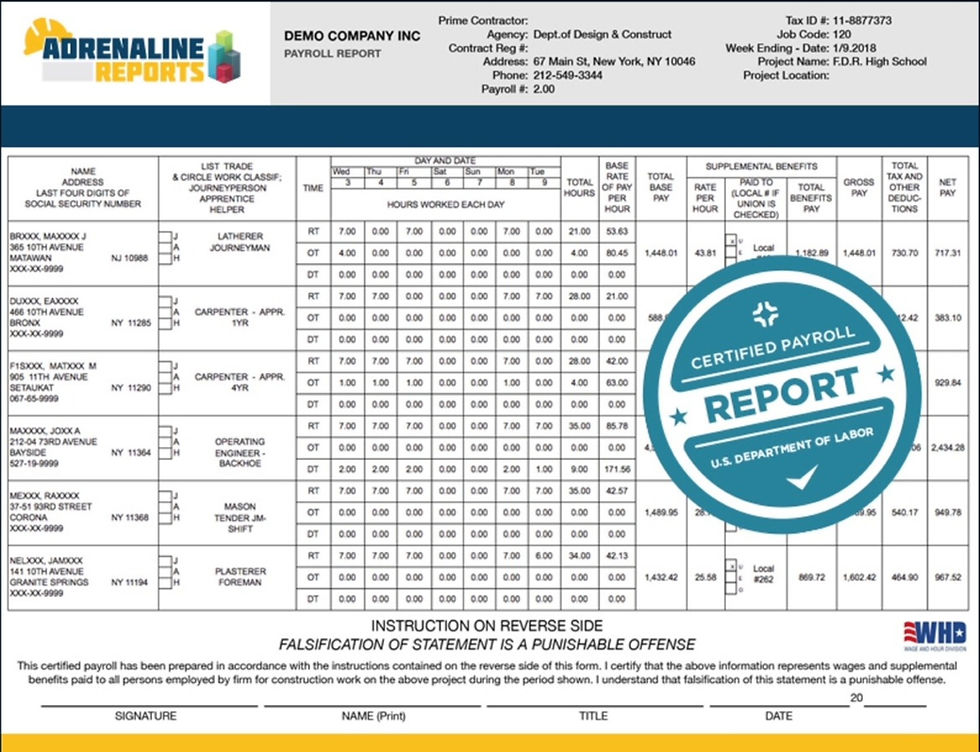

Certified payroll reports - These documents list each worker’s hours, wages, and job classification.

Posting wage determinations - Displaying wage rates at the job site for worker awareness.

Allowing government audits - Agencies may inspect records to verify compliance.

Failure to comply can result in penalties, withholding of payments, or disqualification from future contracts.

Example:

A subcontractor on a highway project failed to submit certified payroll reports on time. The prime contractor withheld payment until the issue was resolved, causing delays.

To streamline this process, many contractors use software solutions for prevailing wage management that automate payroll tracking and reporting.

Common Challenges and How to Overcome Them

Navigating prevailing wage regulations can present several challenges, especially for smaller contractors or those new to public projects.

Challenge 1: Misclassification of Workers

Incorrectly classifying workers can lead to paying the wrong wage rate. For example, labeling a journeyman as an apprentice to reduce costs is a violation.

Solution:

Review job classifications carefully and consult wage determinations. When in doubt, seek guidance from the contracting agency.

Challenge 2: Keeping Up with Changing Rates

Prevailing wage rates can change annually or more frequently.

Solution:

Subscribe to updates from government agencies or use digital tools that automatically update wage rates.

Challenge 3: Managing Multiple Jurisdictions

Projects spanning different counties or states may have varying wage requirements.

Solution:

Segment your payroll and reporting by location and ensure compliance with each jurisdiction’s rules.

By anticipating these challenges and implementing proactive measures, contractors can reduce risks and maintain smooth project operations.

Best Practices for Effective Prevailing Wage Management

Effective prevailing wage management is essential for compliance and project success. Here are some best practices to consider:

Train your payroll and HR staff on prevailing wage rules and reporting requirements.

Use specialized payroll software designed for prevailing wage projects to reduce errors.

Maintain clear communication with subcontractors to ensure they understand their obligations.

Conduct regular internal audits to catch and correct issues early.

Keep thorough documentation of all wage determinations, payroll records, and correspondence.

Adopting these practices not only helps avoid penalties but also builds a reputation for reliability and professionalism in public contracting.

Moving Forward with Confidence in Prevailing Wage Projects

Successfully navigating prevailing wage regulations requires attention to detail, ongoing education, and the right tools. By understanding the rules, budgeting accurately, and maintaining compliance, contractors can confidently pursue public projects and contribute to fair labor standards.

For those looking to simplify the process, exploring prevailing wage management solutions can provide valuable support, automating complex tasks and ensuring accuracy.

With the right approach, prevailing wage regulations become manageable rather than a burden, allowing you to focus on delivering quality work and growing your business.

Comments